Total Cryptocurrency Asset Market Capitalisation

The total cryptocurrency market capitalisation is coming in at around $1.75 trillion, with the fair value logarithmic regression band (red line) at $1.43 trillion. This means that the cryptocurrency asset class remains slightly overvalued when compared to the fair value logarithmic regression trend line by approximately 24%. Given the continued risk-off environment that the macro-economic conditions and geopolitical events have created, the best strategy for the last three months may have been to focus on building a cash position and systematically dollar-cost averaging into positions ready for the next leg up.

Total Cryptocurrency market capitalisation, or the value of all cryptocurrencies in existence, peaked in May 2021 at about $2.4 trillion, up from around $200 billion in 2019. It is important to bear in mind that even during the last peak in the Cryptocurrency cycle in 2018, the market only reached around $720 Billion in value.

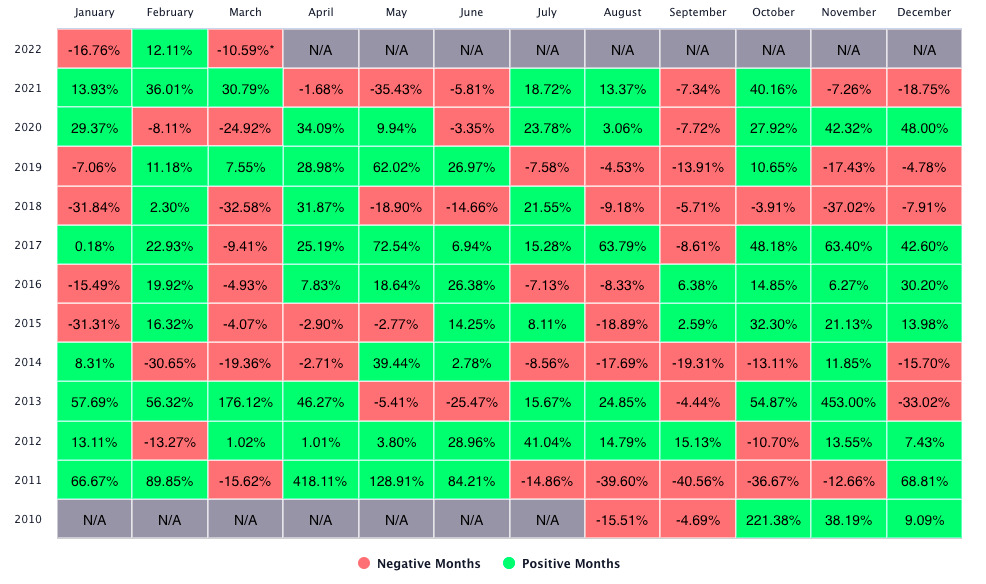

Red March

As you can see above, red Januarys are often followed by double digit gains in February. It did not seem that Bitcoin would hit those double digit gains this past February, but then Bitcoin rallied almost 15% on the last day of the month! Like September, the month of March tends to be red. It does seem likely that Bitcoin will close this month red (but of course there are no guarantees).

100 Day SMA Rejection

The recent rejection off of the 100D SMA shows the relative weakness in Bitcoin right now. It makes sense to assume that the trend remains down until we either get a capitulation candle with a lot of volume, or if Bitcoin can muster up the courage to actually surge past the bull market support band and hold it as support.

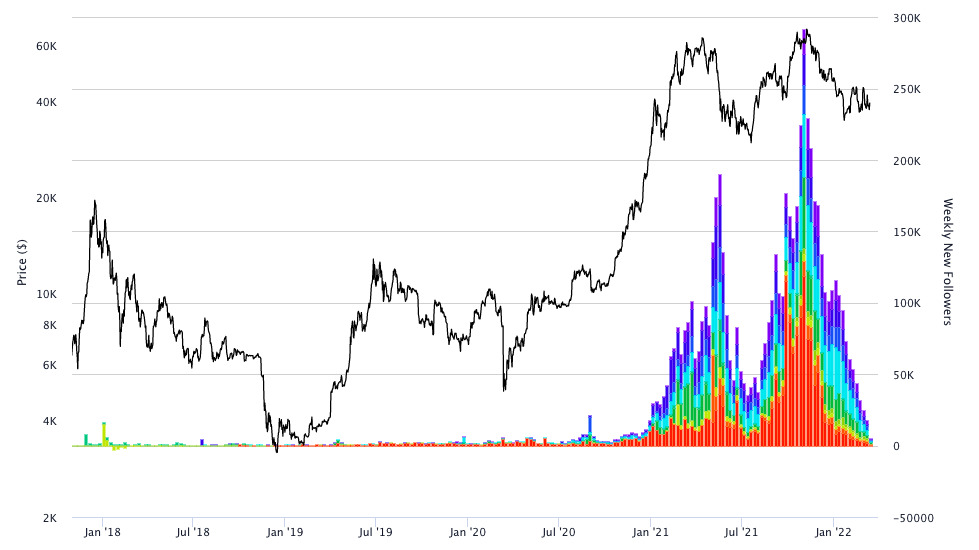

Twitter New Followers

Total new Twitter followers within cryptocurrency is falling from the September high. When interest is waning, you can likely expect lower prices due to lower buying pressure from newer market participants.

Bitcoin Risk Levels

The current risk on Bitcoin is now 0.34 on a scale of 0 to 1 (red line). It is important to keep in mind that any pump that takes Bitcoin higher does not mean anything if Bitcoin cannot go beyond the bull market support band (20-week SMA & 21-week EMA) and then hold it as support. The 0-0.3 risk bands should be considered a possibility, and therefore you need to plan for them in case that happens by having a cash position ready to take advantage of the dip.

Author Bio

Adam Fisher has a duel degree in Economics and works in Financial Planning. He uses his skillset to provide analysis using data science and quantitative finance which is regularly published on his free Newsletter.

James has been a crypto enthusiast for a year. He’s an avid watcher of all the latest developments in the space, and enjoys predicting what will happen next with his favorite coins.

He lives in his hometown of New York City with his wife and two sons. His hobbies include watching movies, playing basketball, and reading about how to survive disasters that may occur from climate change or an asteroid impact!